Term Insurance Meaning Quora

Faltering the rule would lead to claim rejection in the long run. People have realized the importance of term insurance as per their needs.

This type of life insurance provides financial protection to the nominee in case of any unfortunate event with the policyholder during the policy term.

Term insurance meaning quora. A term life insurance policy can offer a substantial cover In case of death of the insured individual during the policy term the death benefit is paid by the insurer to the nominee. You must be very honest and transparent while signing up for term insurance. In case of demise of the insured the sum assured will be paid to the insureds family.

As the name suggests term insurance is a type of insurance plan. In the case of the death of the policyholder the beneficiary gets the death benefit as defined under the term insurance policy. Term insurance is a type of life insurance policy that provides coverage for a certain period of time or a specified term of years.

During this term if the policyholder dies then his family is entitled to receiving a death benefit in terms of a pre-determined lump-sum amount. Life insurance includes term life insurance plan whole life plans endowment plans money back plans ULIPs child Plans investment plans and retirement plans. A term insurance is a pure death benefit policy.

Term insurance is a type of life insurance that provides coverage for a specific period of time or years. In term insurance a specific amount of premiums are to be paid at regular intervals and in return the insurance company pays the insurer a. Term insurance is a type of insurance plan which is taken by the insurer for a particular period of time.

Regardless of how much your policy sum assured is even if its 1 lac you have to disclose your previous policies before taking a new life insurance policy This means term plan ULIPs with insurance cover Traditional Policies. Term insurance plan is important as it provides life cover for the specified period and also safeguards the financial future of the family. Term insurance is a life insurance product which offers financial coverage to the policyholder for a specific term or a time period.

Insurance cover Sum Assured. The objective of this insurance plan is to make sure that the financial needs of the policyholders family are well-taken care of after hisher unfortunate demise. A lump sum death benefit is paid to the beneficiary in case of demise of the insured.

Conclusion - Its better to be safe than sorry. What is an Endowment Policy. Term insurance is a type of life insurance plan which offers financial protection to your family at a very reasonable cost.

Term insurance is the minimum required to provide financial security for your dependents in case of your untimely demise. Definition of Insurance. Under a life insurance plan in exchange for a premium the insurer promises to provide the policy nominee with a pre-decided sum of money upon the death of the policyholder as per applicable terms and conditions.

When a loan has been taken and has to be repaid. Unit Linked Insurance Plans ULIP Insurance Investment Benefits. It provides life cover to the insured against the risk of untimely or pre-mature death during the policy term.

Term insurance is a type of insurance plan which is taken by the insurer for a particular period of time. Non-participating Non-linked endowment plan. For example term insurance can be used as a rider to a cash value insurance policy in order to increase death cover for a specific time period eg.

Term insurance plan is a form of life cover it provides coverage for defined period of time and if the insured expires during the term of the policy then death benefit is payable to nominee. In term insurance a specific amount of premiums are to be paid at regular intervals and in return the insurance company pays the insurer a certain amount called the insurance cover. It pays your family a sum of money in case of your death during the policy term.

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time the relevant term. A term plan provides protection in the form of financial assistance on death but only for a given time period. What is Term Insurance.

But it is different from other insurance plans. Term Insurance is a pure kind of life insurance product which provides financial protection to the policyholder and his family. In case the policyholder passes away the nominee will receive the death benefit.

The term insurance is defined as a contract between two parties whereby one party insurer or insurance company promises to indemnify the specified loss or damage incurred to the other party insured for an adequate consideration ie. This is the simplest type of life insurance policy. Term insurance is a financial protection tool that offers protection cover for a specific number of years.

After that period expires coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions. With affordable premium rates term life insurance plans provide financial protection to the family of the insured in case of any eventuality. When it comes to securing the future of your loved ones or doing a proper financial planning term insurance is one of the most popular options for the insurance seekers.

What Is Term Insurance Plan Quora

Every 30 Year Old Should Make These Financial And Life Investments Career Contessa Investing Career Contessa 30 Years Old

2021 Guide To Term Life Vs Whole Life Insurance Definition Pros Cons

What Is Emi Equated Monthly Instalments Meaning Emi Equatedmonthlyinstalments Loans Mortgages Homelo Financial Tips Parenting Photography Meant To Be

Major Reasons Behind The Rejection Of A Home Loan Application Homeloan Mortgages Rejection Reasons Loan Application Home Loans Loan

What Is Term Life Insurance How Does It Work Quora

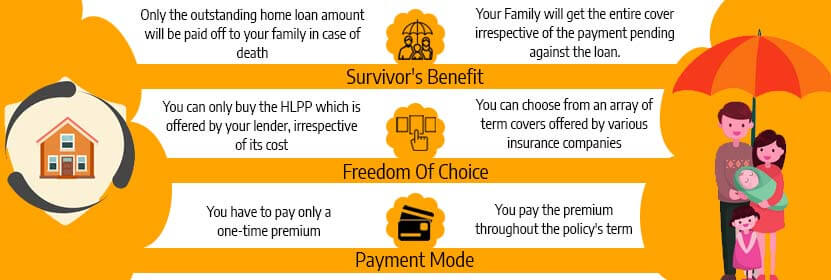

Hlpp Vs Term Insurance Which Is Best If You Have A Home Loan

Proven Difference Between Bill Of Exchange And Promissory Note With Table Promissory Note Accounting Career Bills

What Is Term Insurance Plan Quora

Difference Between Current Account And Overdraft Types Of Bank Accounts Money And Banking Parenting Photography Accounting Banking

Post a Comment for "Term Insurance Meaning Quora"